Global Stock Market Highlights

Last Friday, U.S. stock markets experienced notable declines, primarily driven by renewed trade tensions. President Donald Trump announced potential tariffs, including a 50% levy on European Union imports and a 25% tariff on smartphones manufactured outside the U.S., directly impacting companies like Apple. Apple Inc. shares fell 3% on the day, extending an eight-day losing streak.

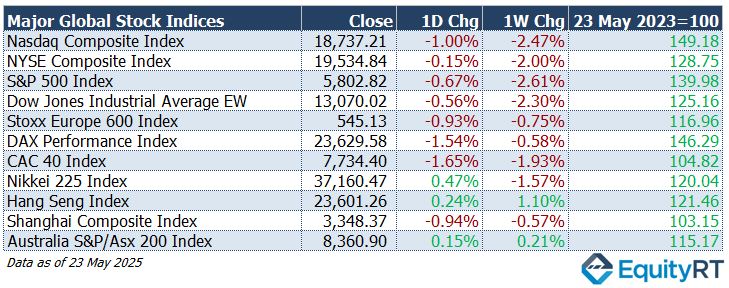

- Nasdaq Composite Index closed at 18,737.21, down 1.00% on the day and down 2.47% for the week.

- NYSE Composite Index closed at 19,534.84, down 0.15% on the day and down 2.00% for the week.

- S&P 500 Index closed at 5,802.82, down 0.67% on the day and down 2.61% for the week.

- Dow Jones Industrial Average EW closed at 13,070.02, down 0.56% on the day and down 2.30% for the week.

On Friday, European stock markets experienced significant declines following U.S. President Donald Trump’s announcement of a proposed 50% tariff on all European Union imports, effective June 1. This development raised concerns over a potential escalation in global trade tensions. The proposed tariffs, coupled with threats of additional levies on foreign-manufactured smartphones, notably impacted investor sentiment, leading to widespread declines across European markets.

- Stoxx Europe 600 Index closed at 545.13, down 0.93% on the day and down 0.75% for the week.

- DAX Performance Index closed at 23,629.58, down 1.54% on the day and down 0.58% for the week.

- CAC 40 Index closed at 7,734.40, down 1.65% on the day and down 1.93% for the week.

Asian stock markets exhibited mixed performances, influenced by easing U.S. Treasury yields and developments in U.S. fiscal policy. While markets in Japan and China faced some headwinds, Hong Kong and India experienced positive momentum, influenced by global economic developments and sector-specific performances.

- Nikkei 225 Index closed at 37,160.47, up 0.47% on the day but down 1.57% for the week.

- Hang Seng Index closed at 23,601.26, up 0.24% on the day and up 1.10% for the week.

- Shanghai Composite Index closed at 3,348.37, down 0.94% on the day and down 0.57% for the week.

- Australia S&P/ASX 200 Index closed at 8,360.90, up 0.15% on the day and up 0.21% for the week.

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 99.11, down 0.83% on the day and 1.96% for the week, marking an 8.61% decline year-to-date as broader currency market pressures persist.

- The Brent crude oil, the global oil price benchmark, settled at $64.78 per barrel, inching up 0.53% on Friday but slipping 0.96% over the week, and is down 13.21% since the start of the year, reflecting ongoing demand concerns.

- The Gold surged to $3,358.00 per ounce, gaining 1.76% on the day and 4.81% for the week, bringing its year-to-date rally to 27.95%, as investors seek safe-haven assets amid global uncertainty.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, finished at 4.00%, up 0.30 bps on the day, down 1.00 bps over the week, and 24.80 bps lower year-to-date.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, ended at 4.52%, falling 2.20 bps on Friday but up 3.40 bps for the week, while still 5.80 bps below year-start levels, highlighting mixed signals on long-term inflation and growth.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

Markets are gearing up for a potentially volatile week, as fresh geopolitical and economic uncertainties weigh on investor sentiment. Tensions escalated last Friday when President Donald Trump reintroduced tariff threats, this time singling out both the European Union and Apple. The move has reignited concerns over global trade relations, adding a new layer of complexity to market dynamics already shaped by inflation and interest rate expectations.

In the U.S., market participants will be watching Federal Reserve officials closely, with a series of scheduled speeches and the release of the latest FOMC minutes offering potential clues on the Fed’s future rate path. These events take on added importance as investors seek confirmation on whether the central bank might consider easing its policy stance in the face of cooling inflation and slowing economic growth.

High on the agenda will be the personal income and outlays report. Analysts anticipate a modest 0.2% increase in consumer spending for April, down sharply from March’s 0.7%, suggesting that household demand may be losing steam. If confirmed, this slowdown could reinforce expectations for a more cautious Fed in the months ahead.

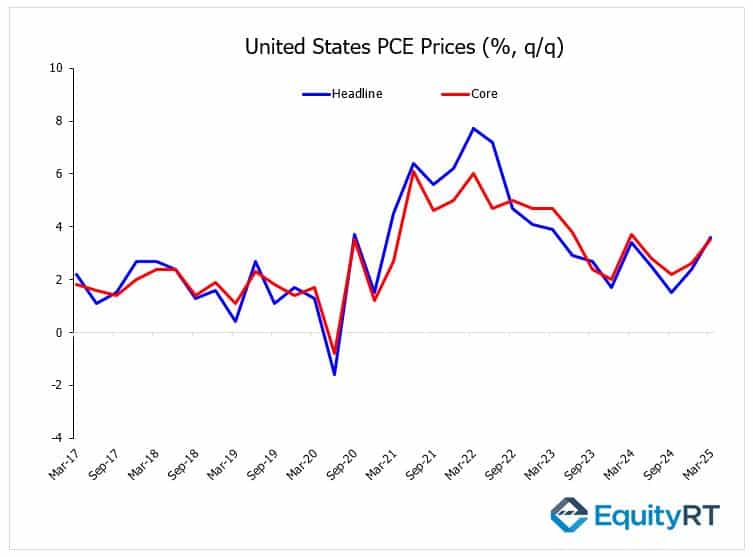

On Thursday, markets will turn their focus to the second estimate of quarterly PCE price data, a key inflation metric tracked by the Federal Reserve. According to advance estimates, core PCE prices in the U.S. rose by 3.5% in the first quarter of 2025, marking a notable acceleration from 2.6% in the previous quarter and surpassing expectations of a 3.3% increase. T

Headline PCE prices also surged, climbing 3.6%, the strongest gain in two years, following a 2.4% rise in Q4 2024. Historically, PCE price growth has averaged 3.14% on a quarterly basis since 1947, with extremes ranging from a peak of 13.3% in Q1 1951 to a low of -6.2% during the global financial crisis in Q4 2008.

The upcoming revision will be closely scrutinized for clues on inflation persistence and its implications for Fed policy.

Also in focus is the second estimate of Q1 GDP, widely expected to confirm the economy’s first quarterly contraction in three years. The downturn is largely attributed to a sharp 41.3% surge in imports, which weighed heavily on net trade. Alongside this, updated readings on Q1 corporate profits will shed light on how companies are navigating a more challenging operating environment.

A broad set of data releases will also help shape the market outlook, including durable goods orders, pending home sales, Case-Shiller home prices, and key confidence indicators like the Conference Board’s consumer confidence index and the University of Michigan’s sentiment gauge. Trade and industrial activity will also be in the spotlight with advance estimates for the goods trade balance, wholesale inventories, the Chicago PMI, and the Dallas Fed manufacturing index.

Canada and Brazil are scheduled to release Q1 GDP figures, offering a window into their respective growth trajectories. Meanwhile, updated labor market data from Mexico and Brazil will provide further insight into regional economic resilience.

A mix of geopolitical flare-ups, pivotal central bank signals, and heavyweight economic indicators will test market nerves this week — with volatility likely to remain a dominant theme.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

In Europe, market attention turns to a flurry of key economic indicators, with preliminary inflation data from Germany, France, Italy, and Spain expected to offer critical clues on the path of price pressures across the region.

In Germany, consumer sentiment appears to be on the mend, with the GfK Consumer Climate Indicator projected to rise to a seven-month high, signaling a cautiously improving outlook among households. Retail sales are also anticipated to post a modest 0.3% rebound in April, offering some relief after March’s dip.

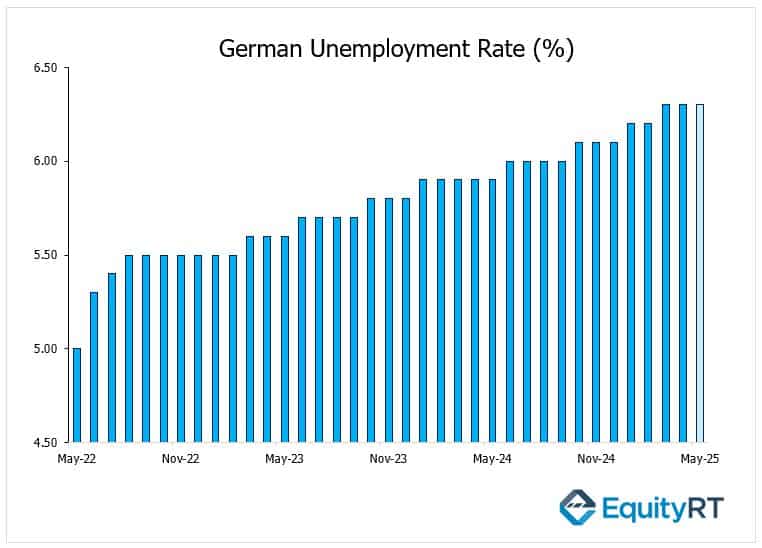

However, the labor market presents a mixed picture—Germany’s unemployment rate is likely to hold steady at 6.3%, its highest level since September 2020, with jobless claims seen increasing by 10,000, suggesting underlying weakness.

Beyond Germany, broader Eurozone business sentiment will be closely monitored, along with retail trends data from the UK’s CBI, French unemployment figures, and key indicators from Switzerland including trade data, retail sales, and the KOF leading index.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

In Asia, economic updates will offer fresh insight into regional growth and monetary policy dynamics. China is set to publish industrial profit data through April, which will be closely watched for signals on how the brief US-China trade tensions have affected manufacturing and goods demand.

In Japan, attention will turn to the May consumer confidence index, potentially revealing sentiment shifts linked to rising borrowing costs. Additional key data from Japan—including April’s industrial production, unemployment, retail sales, and housing starts—will provide a broader snapshot of economic momentum.

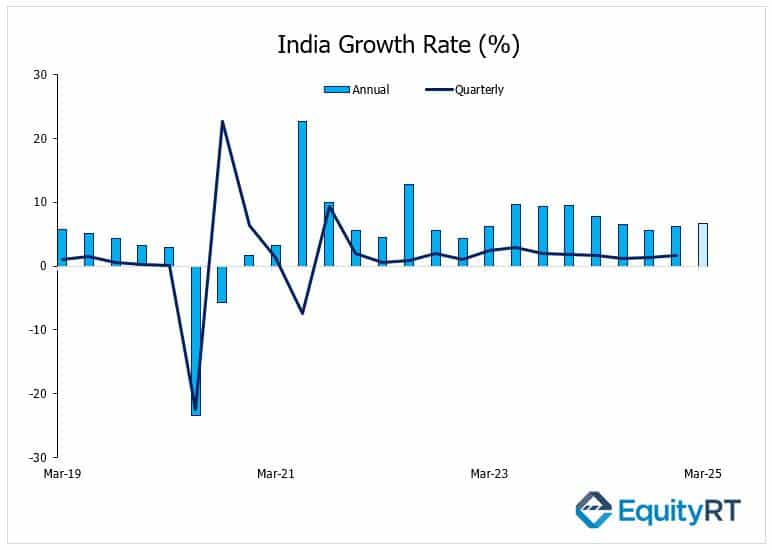

Markets will be watching closely as India prepares to release its March-quarter GDP data on Friday. A further acceleration is anticipated, likely reinforcing India’s position as a key economic outperformer in the region.

India’s GDP grew by 6.2% year-on-year in the December quarter of 2024, up from a revised 5.6% in the previous quarter, though just shy of the 6.3% growth forecast. While still solid, the figure reflects a broader trend of moderation from the rapid pace that had made India the fastest-growing G20 economy in recent years. The slowdown has been shaped by persistently high energy and food prices, alongside the Reserve Bank of India’s tight monetary policy and constrained liquidity conditions.

April’s industrial production figures will also be closely monitored for confirmation of continued expansion.

Elsewhere, the Bank of Korea is widely expected to cut its policy rate, as recent strength in the won provides policymakers space to focus on reviving growth.

In Australia, monthly CPI data and the ANZ business confidence index are due, shedding light on inflation dynamics and corporate sentiment. Meanwhile, New Zealand’s central bank, the RBNZ, is likely to continue its easing cycle with a 25-basis point rate cut, reflecting lingering growth concerns.