Global Stock Market Highlights

Stocks were initially higher following strong jobs data, but a sharp decline in consumer sentiment caused major U.S. indexes to fall into negative territory.

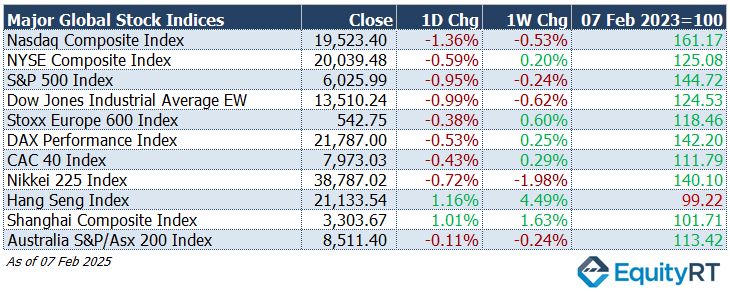

- Nasdaq Composite Index closed at 19,523.40, declining 1.36% on the day and 0.53% for the week.

- NYSE Composite Index closed at 20,039.48, declining 0.59% on the day but gaining 0.20% for the week.

- S&P 500 Index closed at 6,025.99, declining 0.95% on the day and 0.24% for the week.

- Dow Jones Industrial Average EW finished at 13,510.24, declining 0.99% on the day and 0.62% for the week.

Last Friday, European stocks dipped lower on Friday but still posted weekly gains, as investors weighed corporate earnings, monetary policy, and crucial U.S. jobs data.

- Stoxx Europe 600 Index settled at 542.75, declining 0.38% on the day but gaining 0.60% for the week.

- DAX Performance Index closed at 21,787.00, declining 0.53% on the day but gaining 0.25% for the week.

- CAC-40 Index closed at 7,973.03, declining 0.43% on the day but gaining 0.29% for the week.

Asia-Pacific markets showed a mixed performance on Friday as investors analysed India’s interest rate decision and Japan’s household spending figures.

- Nikkei 225 Index finished at 38,787.02, declining 0.72% on the day and 1.98% for the week.

- Hang Seng Index closed at 21,133.54, rising 1.16% on the day and 4.49% for the week.

- Shanghai Composite Index closed at 3,303.67, rising 1.01% on the day and 1.63% for the week.

- Australia’s S&P/ASX 200 Index closed at 8,511.40, declining 0.11% on the day and 0.24% for the week.

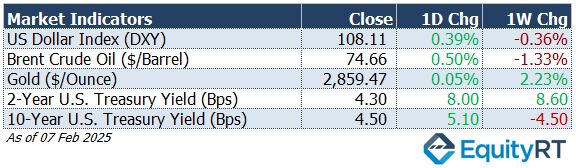

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 108.11, rising 0.39% on the day but declining 0.36% for the week.

- The Brent crude oil, the global oil price benchmark, settled at $74.66 per barrel, increasing 0.50% on the day but declining 1.33% for the week.

- The Gold finished at $2,859.47 per ounce, rising 0.05% on the day and 2.23% for the week.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, rose to 4.30 basis points, up 8.00 bps on the day and 8.60 bps for the week.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, increased to 4.50 basis points, rising 5.10 bps on the day but falling 4.50 bps for the week.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

Powell is set to address Congress this week, with a likely focus on interest rates and the current state of the economy.

On Wednesday, the Consumer Price Index (CPI) for January will be released, providing an initial look into last month’s inflation figures, followed by the Producer Price Index (PPI) for January on Thursday.

In December 2024, the CPI saw a significant monthly increase of 0.4%, the highest since March, compared to 0.3% in November and expectations of 0.3%. This rise was mainly driven by higher energy costs. While shelter and food prices also experienced modest increases, sectors like used cars and personal care items saw slight declines.

The annual inflation rate rose to 2.9% in December 2024, marking the 3rd consecutive monthly increase, in line with forecasts. This rise was largely due to lower base effects from the previous year, particularly in energy prices.

For January, the consumer inflation is expected to have increased by 0.3% monthly, a slight slowdown from December’s 0.4% rise. Core CPI likely accelerated to 0.3%, up from 0.2%.

The PPI is anticipated to have risen by 0.2% in monthly basis, matching December’s increase.

Earnings results from major companies like McDonald’s, Coca-Cola, and Shopify will provide insights into the state of consumer sentiment in the U.S.

Investors will be closely monitoring inflation data from Brazil and industrial production in Mexico.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

According to the Bank of England’s latest meeting, GDP is estimated to have contracted by 0.1% in Q4, with a modest recovery of 0.1% projected for Q1 2025.

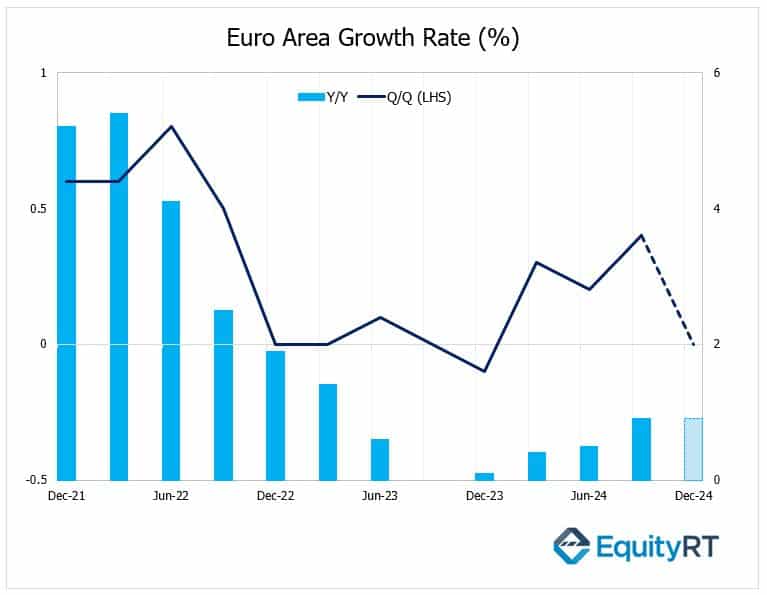

On Friday, investors will be looking closely at the second estimate of GDP data for the Euro Area.

Preliminary data for the region showed an unexpected stagnation (0%) at the end of last year, with declines in both Germany and France raising concerns about a potential recession. This followed a 0.4% growth in Q3 and a forecasted 0.1% expansion.

The Euro Area economy grew by 0.9% year-on-year in Q4 2024, matching the growth rate of Q3, but falling short of the expected 1% increase, according to a flash estimate.

The region continues to struggle with a deepening industrial recession, high energy costs, and sluggish consumer and government spending.

The Bank of Russia is expected to keep its benchmark interest rate at 21%, while Russia’s annual inflation rate is anticipated to rise to 10% in January, the highest level in nearly a year.

Other key economic indicators to watch include Eurozone industrial output, Germany’s wholesale prices, the UK’s BRC retail sales, Switzerland’s inflation rate, as well as GDP growth figures for Norway.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

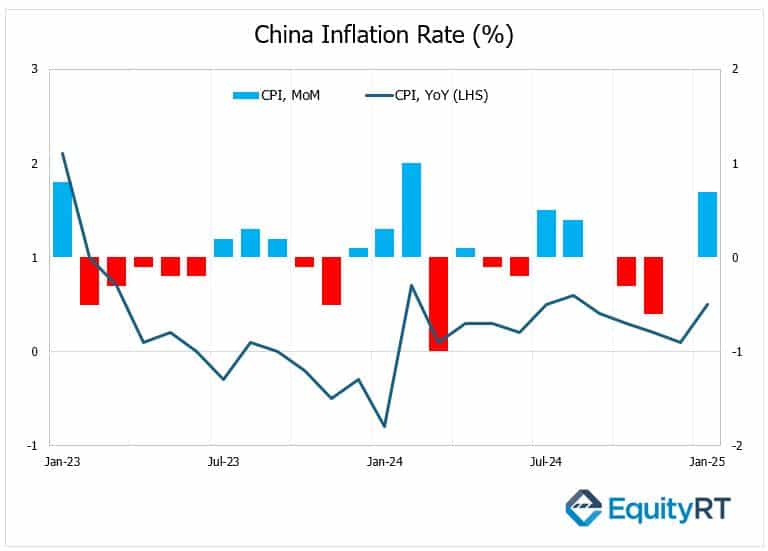

China’s annual inflation rate rising to 0.5% in January 2025, up from 0.1% in December and surpassing market expectations of 0.4%, signalled a potential shift in economic dynamics. This increase, the highest since August 2024, is largely attributed to seasonal factors related to the Lunar New Year.

Japan’s economic calendar is relatively quiet, with the December current account standing out as the main release.

In India, inflation is anticipated to exceed 5% following the central bank’s rate cut, and the trade balance will provide insights into the impact of the rupee’s depreciation.

South Korea will be closely watched, with investors keen to see if the unemployment rate remains high following recent political turmoil, in addition to key trade data.

In Australia, important economic releases include the Westpac consumer confidence index for February, the NAB business confidence index, and Q4 home credit data.