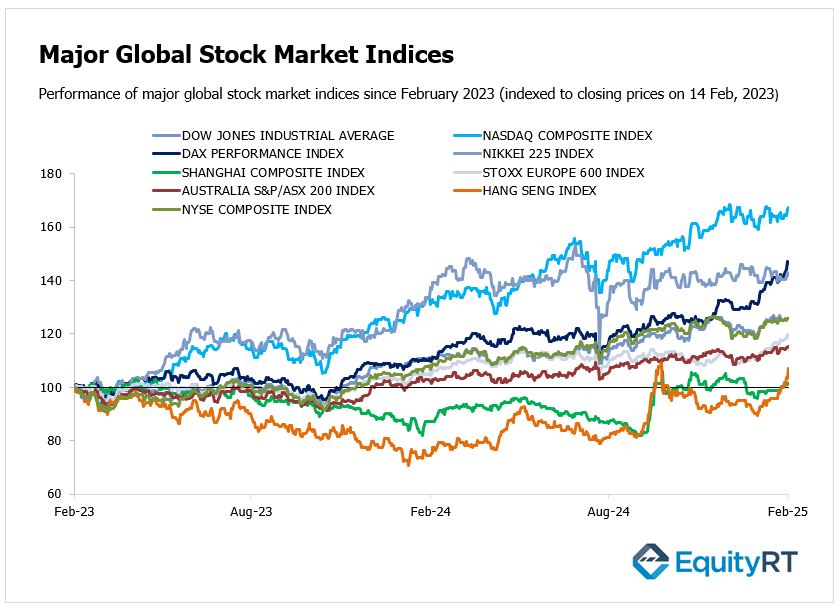

Global Stock Market Highlights

Last Friday, Wall Street missed a record high as mixed earnings reports from major companies weighed on the market. However, a weaker-than-expected retail sales data drove the 10-year Treasury yield down by 5 bps to 4.48%, offering some support to stocks.

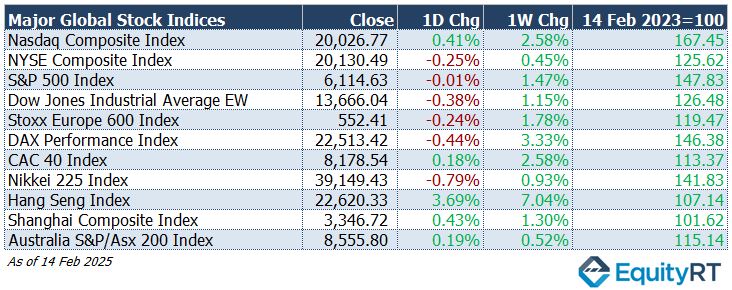

- Nasdaq Composite Index closed at 20,026.77, gaining 0.41% on the day and 2.58% for the week.

- NYSE Composite Index closed at 20,130.49, down 0.25% on the day but up 0.45% for the week.

- S&P 500 Index closed at 6,114.63, slipping 0.01% on the day but rising 1.47% for the week.

- Dow Jones Industrial Average EW finished at 13,666.04, falling 0.38% on the day but increasing 1.15% for the week.

** US stock and bond markets will remain closed on Monday for Presidents Day.

European stock markets ended lower on Friday, retreating from record highs reached earlier in the week. The decline came as investors weighed a wave of corporate earnings reports and the potential for a peace agreement to resolve the war in Ukraine.

- Stoxx Europe 600 Index settled at 41, down 0.24% on the day but up 1.78% for the week.

- DAX Performance Index closed at 22,513.42, losing 0.44% on the day but climbing 3.33% for the week.

- CAC-40 Index closed at 8,178.54, rising 0.18% on the day and 2.58% for the week.

Asia-Pacific markets showed a mixed performance on Friday, following overnight gains on Wall Street after President Donald Trump signed a reciprocal tariffs plan, though he postponed immediate implementation of the levies.

- Nikkei 225 Index finished at 39,149.43, dropping 0.79% on the day but gaining 0.93% for the week.

- Hang Seng Index closed at 22,620.33, surging 3.69% on the day and 7.04% for the week.

- Shanghai Composite Index closed at 3,346.72, gaining 0.43% on the day and 1.30% for the week.

- Australia’s S&P/ASX 200 Index closed at 8,555.80, rising 0.19% on the day and 0.52% for the week.

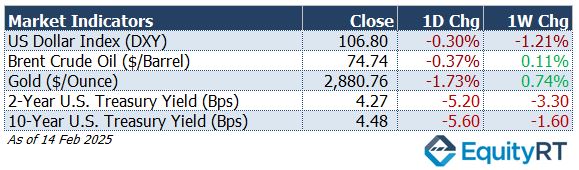

- The Dollar Index (DXY), a closely watched gauge of the U.S. dollar’s performance against other major currencies, closed at 106.80, declining 0.30% on the day and 1.21% for the week.

- The Brent crude oil, the global oil price benchmark, settled at $74.74 per barrel, down 0.37% on the day but edging up 0.11% for the week.

- The Gold finished at $2,880.76 per ounce, dropping 1.73% on the day but gaining 0.74% for the week.

- The 2-year U.S. Treasury yield particularly responsive to Federal Reserve policy rates, ended at 4.27 bps, falling 5.20 bps on the day and 3.30 bps for the week.

- The 10-year U.S. Treasury yield an indicator of long-term borrowing costs, closed at 4.48 bps, down 5.60 bps on the day and 1.60 bps for the week.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Upcoming U.S. Economic Indicators to Watch This Week

This week in the US, markets will focus on the FOMC minutes and speeches from several Federal Reserve officials for clues on the central bank’s policy direction. On the economic data front, S&P Global PMIs will provide an early gauge of February’s economic activity.

The NY Empire State Manufacturing Index is projected to show a smaller contraction in New York’s manufacturing sector, while the Philadelphia Fed Manufacturing Index is expected to decline from its 2021 peak.

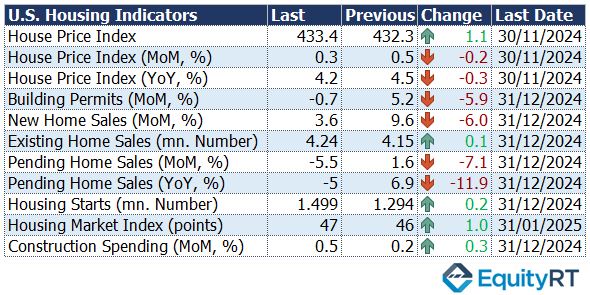

Housing market updates, including the NAHB Housing Market Index, building permits, housing starts, and existing home sales, will be closely watched, with most data pointing to a market slowdown.

Additionally, final readings for the Michigan Consumer Sentiment Index are due on Friday.

In corporate earnings, major reports from Walmart and Booking Holdings will be in focus.

In the Americas, Canada’s inflation data for January will be released on Tuesday. In December 2024, the Consumer Price Index (CPI) decreased by 0.4% month-over-month, marking the first decline in three months. Annual inflation eased to 1.8%, down from 1.9% in November and below market expectations, representing the slowest pace since September. For January, CPI is expected to rise by 0.1%.

Unleash Your Investment Potential. EquityRT might be the missing puzzle piece to reach your ultimate investment strategy.

European Economic Trends: This Week’s Macro Insights

This week in the Europe, flash PMIs for the Euro Area will be closely watched, with services expected to grow slightly faster and manufacturing to contract less.

The Euro Area will release its flash consumer survey results for February. Consumer confidence in the Euro Area increased by 0.3 points to -14.2 in January 2025, matching preliminary estimates.

Germany’s ZEW sentiment index is anticipated to show improved investor confidence in February.

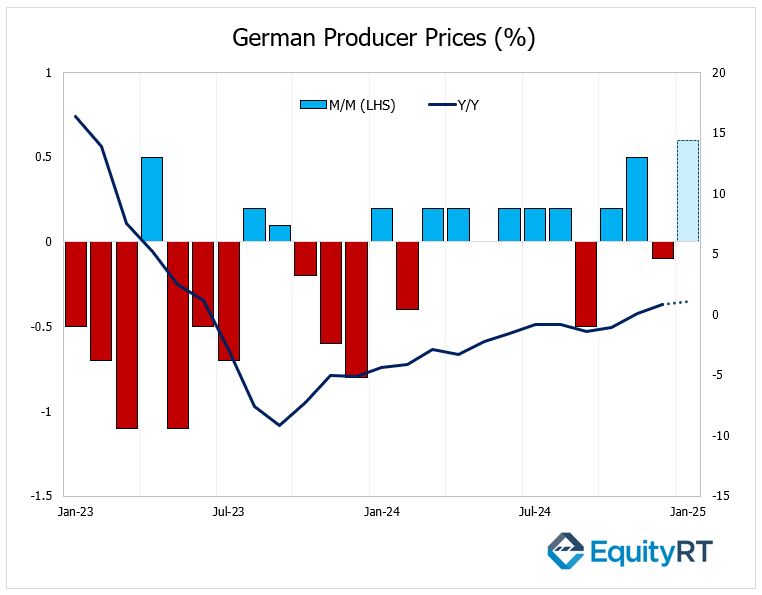

On Thursday, Germany’s producer prices for January will be released.

Germany’s producer prices dropped 0.1% in December 2024, missing the expected 0.3% rise and following a 0.5% increase in November. Producer prices rose 0.8% year-on-year, up from 0.1% in November but below the expected 1.1%. This marked the second straight month of price growth after over a year of decline, mainly due to higher costs for capital goods and non-durable consumer goods. Energy prices dropped by 0.2%, as higher heating costs balanced out the decreases in natural gas, electricity, and fuel prices.

For January, monthly producer prices are expected to rise by 0.6% while annual producer prices are expected to increase by 1.1%.

Other significant data releases include trade data for the Euro Area.

In the United Kingdom, key figures on unemployment, inflation, retail sales, and flash PMIs will be closely tracked by investors. The jobless rate is forecasted to rise to 4.5%, while wage growth is expected to reach an 8-month high. On the inflation front, headline figures are set to rise to a 10-month high, while retail sales are likely to have rebounded in January. Investors will also keep an eye on GfK consumer confidence, the CBI measure for factory orders, and public sector net borrowing.

Take the Guesswork out of Investing: Backtest Your Strategies with Ease!

Asian Economic Data: This Week’s Outlook

This week in China, the focus will be on January housing prices, which will indicate whether stronger credit growth and reports of local governments starting home-buying programs have eased the property crisis.

The People’s Bank of China (PBoC) is expected to keep its loan prime rates unchanged to support the yuan.

Japan is set for a busy week with its Q4 2024 GDP release, showing a 0.7% growth—surpassing expectations of 0.3%.

Beside growth figures, investors will track January’s trade balance, inflation rate, February PMIs, and December machinery orders.

In India, attention will be on PMIs, trade data, and minutes from the RBI’s recent meeting, which marked the first rate cut in five years.

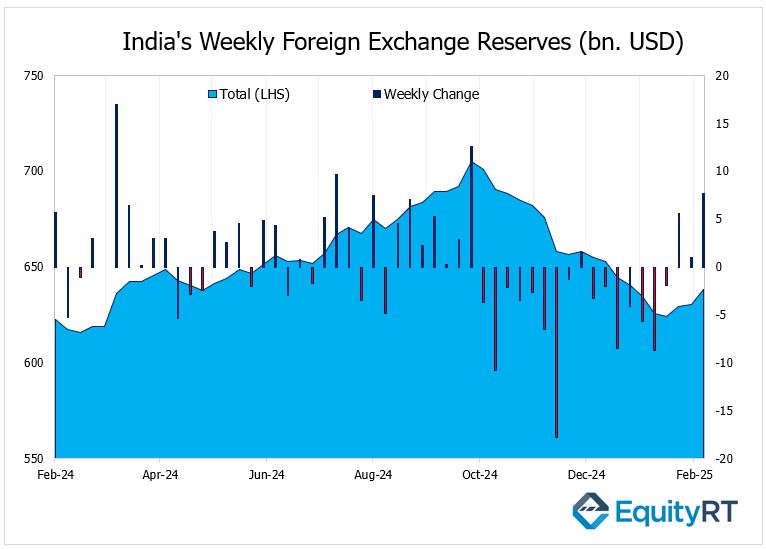

India’s foreign exchange reserves for the week ending February 14 will be released on Friday.

India’s foreign exchange reserves have been on the rise for 3 consecutive weeks, reversing months of decline. As of February 7, reserves increased by $7.65 billion to $638.26 billion, following a sharp drop that had taken reserves to an 11-month low.

This recovery comes after reserves fell nearly 10% from their all-time high of $704.89 billion in September, mainly due to the Reserve Bank of India (RBI) intervening in the forex market to stabilize the Indian Rupee, which has been close to record lows against the US dollar.

South Korea will focus on February business and consumer confidence.

In Australia and New Zealand, monetary policy will be in the spotlight, with the RBA expected to begin its rate-cutting cycle with a 25bps reduction, and the RBNZ likely to cut rates by 50bps.

Additionally, Australia will update its employment data, and New Zealand will release its trade balance.