2021 has been one of the years to remember for all of us- as well as for investors. Markets outperformed differently in 2021 compared to 2020. The stock market reached new highs, investors benefited from strong returns in global equities and the United States marked one of the strongest economic growth in recent years.

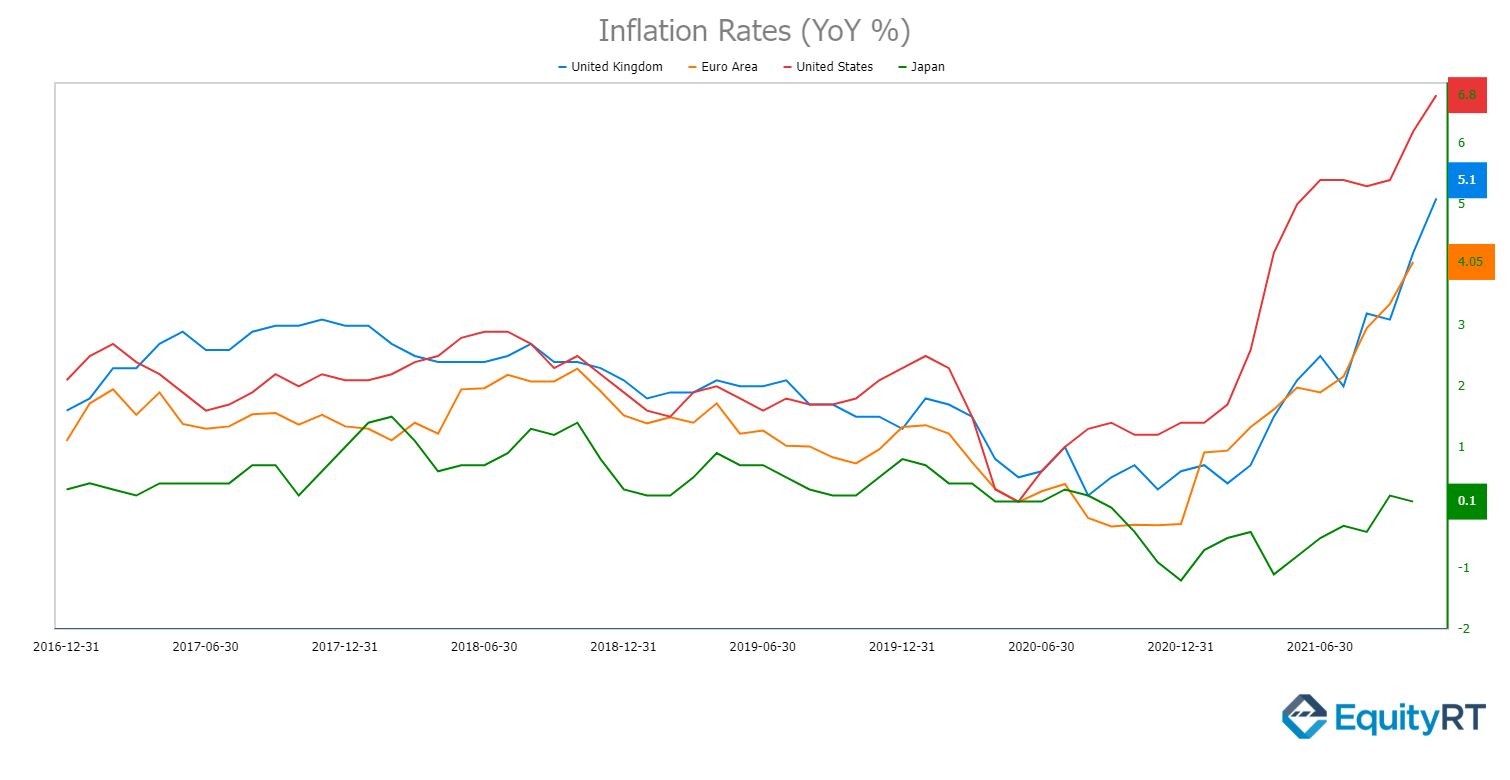

From a macro perspective, 2021 has been a year of economic recovery, rebound, and notable rise in inflation. The mix of supportive monetary and fiscal packages during the Covid-19 pandemic, supply constraints, and rebounding demand resulted in persistent inflation. Most central banks have been expecting rising inflation to prove to be transitory but the inflation is expected to stay in 2022. The rise in energy prices, the supply-chain shortages have been the major drivers of recent inflation.

We have determined four key indicators of the United States’ economy to look at, from the EquityRT’s “Economics” section:

All the information you need in one place. Add EquityRT to your toolkit for quality investment research.

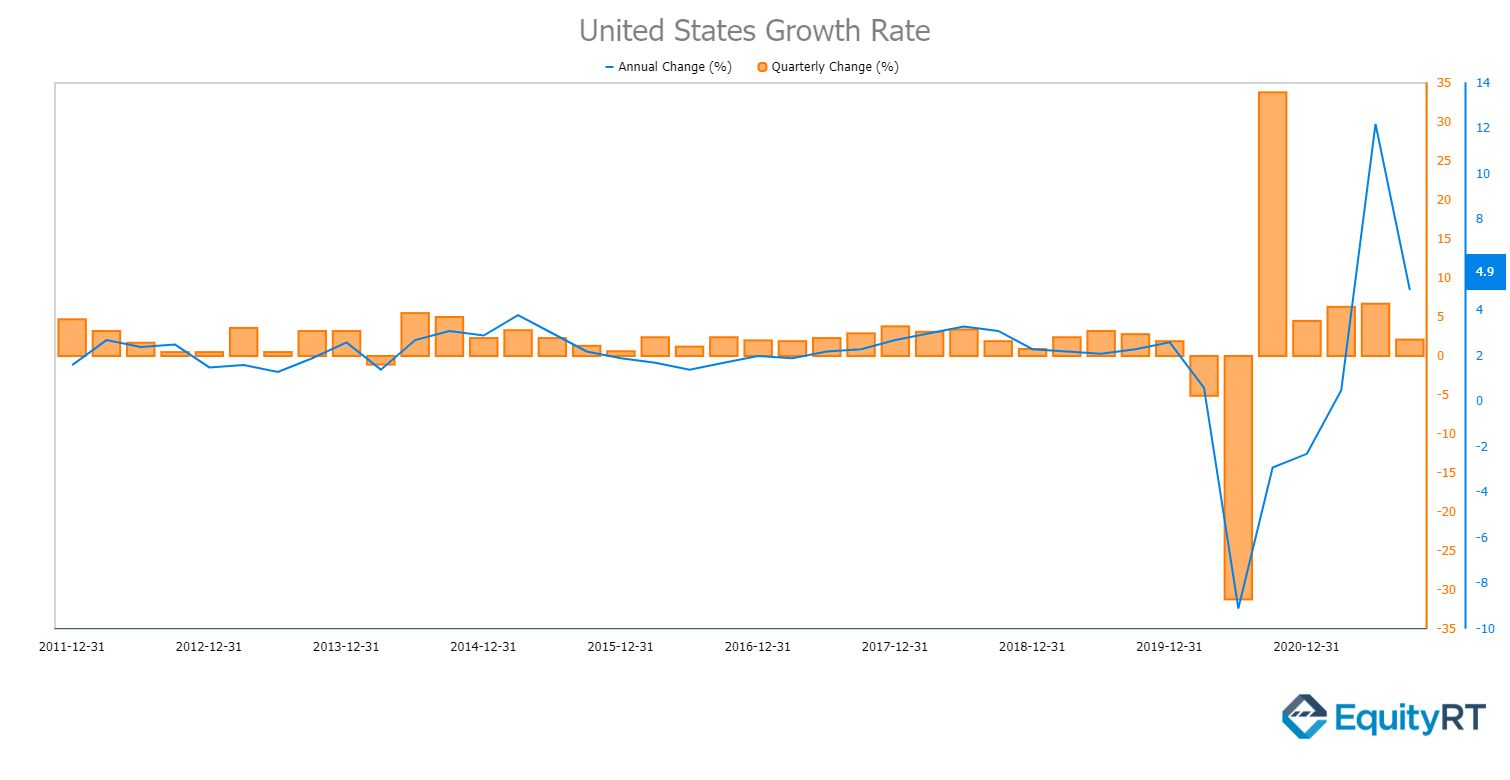

Growth

The U.S. economy expanded at an annualized rate of 2.1 percent in the third quarter of 2021 slightly higher than 2% in the advance estimate. This was the slowest GDP growth since the second quarter of 2020.

To remember- in March 2020, the Covid-19 pandemic had led to a record contraction in the U.S economic activity, resulting in a decline of 5.1 percent in the first quarter and 31.2 percent in the second quarter of 2020.

In 2021, U.S. households received stimulus cheques from the government which helped encourage the higher spending that drove economic growth.

According to the quarterly forecasts of Trading Economics, economic improvement in the United States will continue in 2022.

In the long-term, the United States growth rate is projected to trend around 1.70% in 2022 and 1.90 percent in 2023, according to Trading Economics’ econometric models.

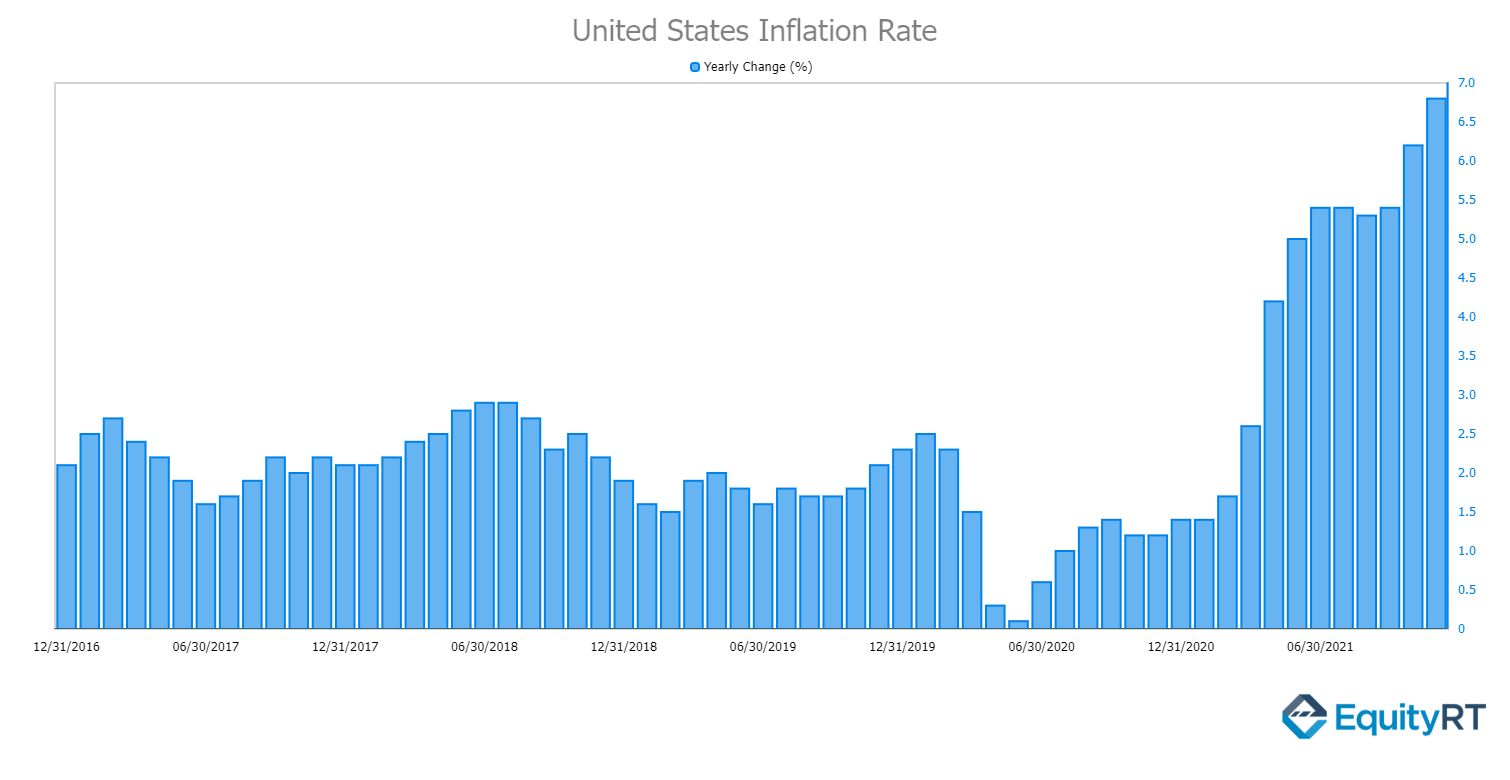

Inflation

Global inflation has increased substantially in 2021. Disruptions in food, energy, and other commodities have pushed up prices which resulted in inflation pressures in all economies.

It has already taken a toll on much of the world but the United States has been one of the most affected in the last few months. The annual inflation rate in the United States rose to 6.8% in November, logging the highest surge in almost 40 years. The latest increase marked the ninth consecutive monthly rise above the Fed’s target (2%).

There are many methods to measure inflation in the United States, the consumer price index released by the U.S. Bureau of Labour Statistics is the most-watched economic indicator to gauge inflation.

The consumer inflation expectations in the United States for the year ahead edged up to a fresh record of 6% in November of 2021 from 5.7% in October. The medium-term (three-year ahead inflation) expectations edged down to 4% from 4.2%, the first decline since June 2021.

In the Fed’s new economic projections, policymakers forecast that inflation will run at 2.6% in 2022, then fall to 2.3% in 2023. That being the case, the Fed needs to prepare probable plans if a 5% inflation rate looks like it is becoming sticky, with inflation expectations rising.

Higher energy prices and supply imbalances are likely to challenge recovery and rise inflation in the coming quarters. We can expect that an easing of these issues in 2022 may bring some price relief, but they are expected to only gradually resolve during 2022.

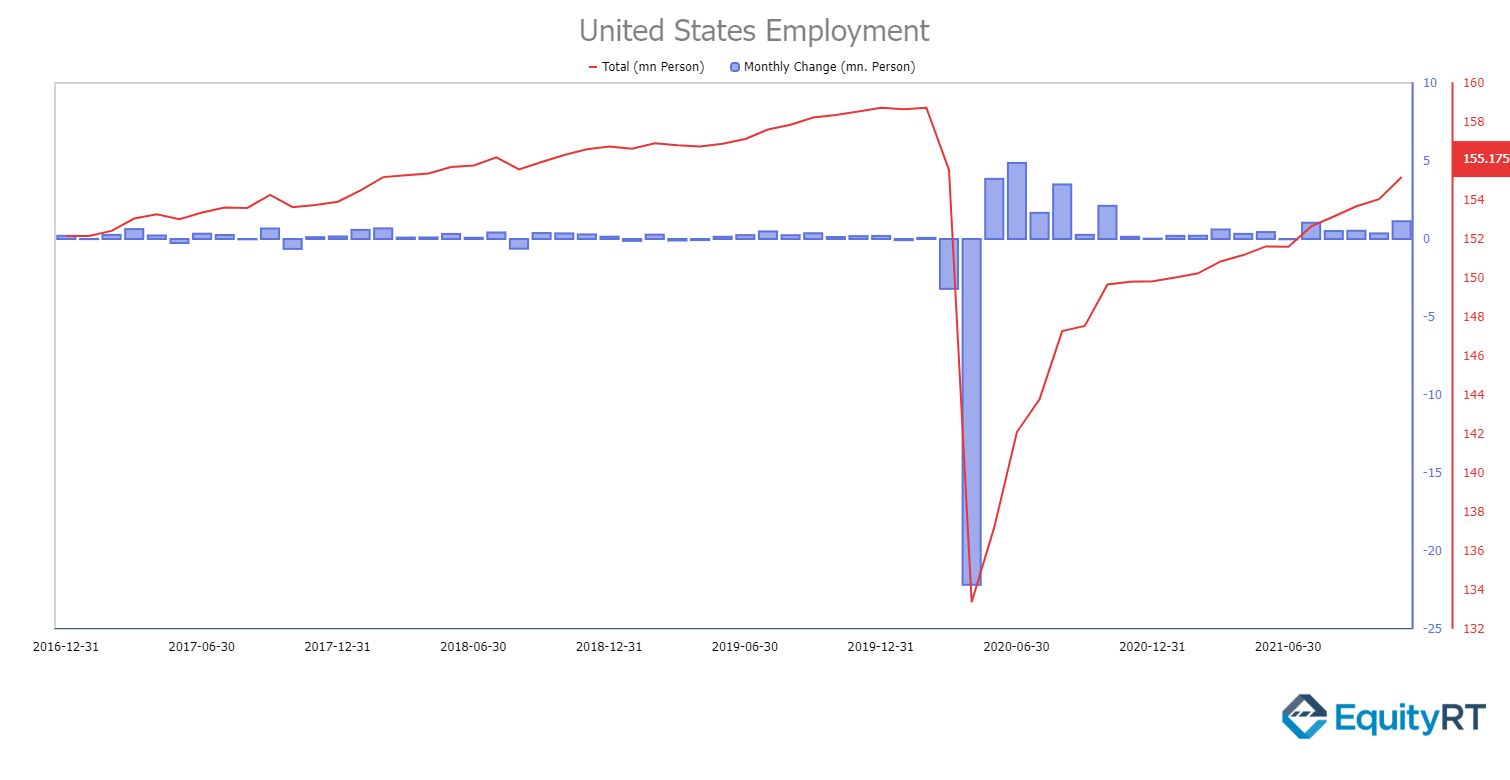

Employment and The Fed’s Rate

In 2021, massive support packages and the rollout of vaccines helped revive the economy and the job market in the United States. Current employment is still 3.1 persons short of its February 2020 level and the prospects for the economy remain vulnerable to Covid-19 variants. The main challenge is on labour supply and wages.

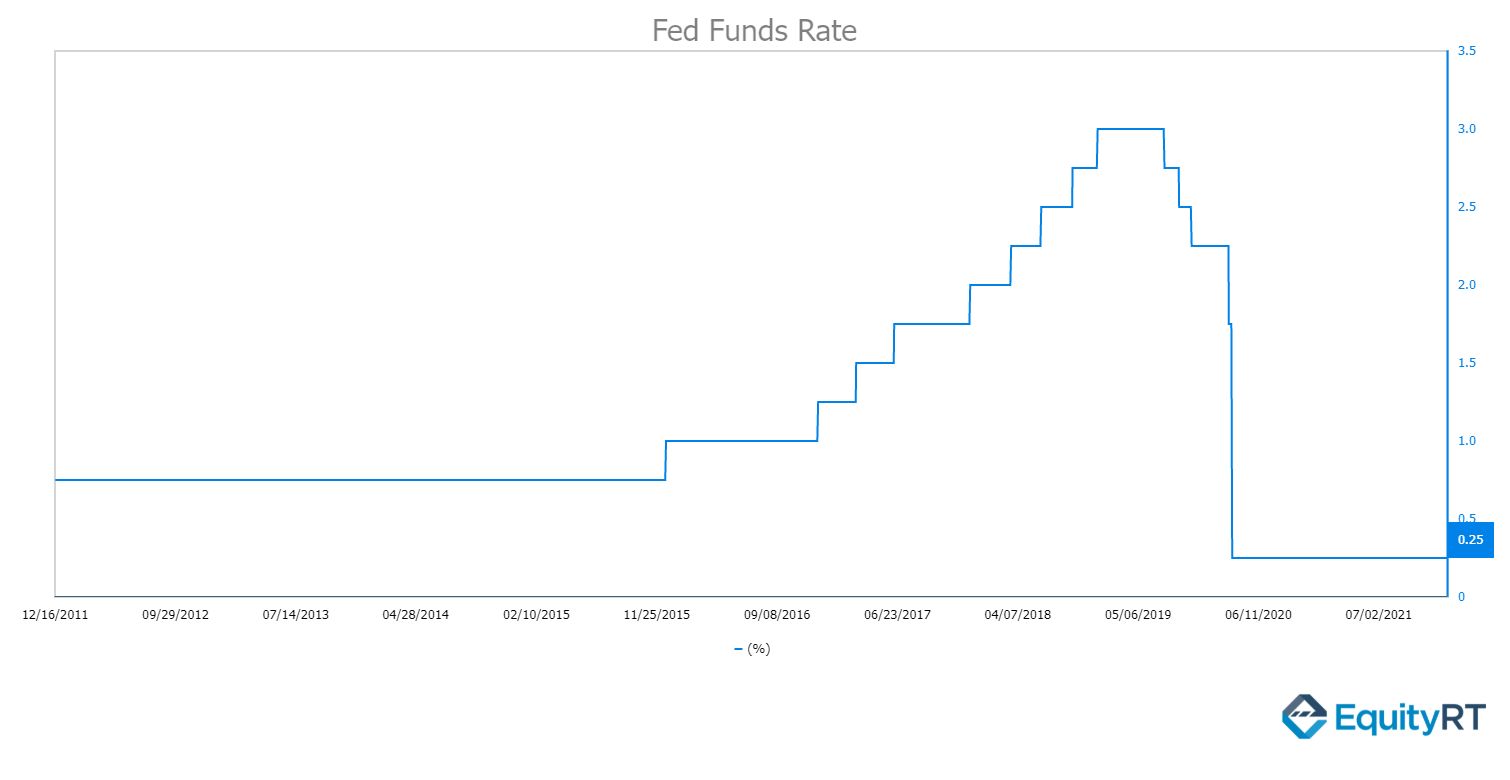

The new economic projections released on December 16, by the U.S. Fed left little doubt that the borrowing costs will increase in 2022. The Fed’s recent forecast that it will raise its policy rate three times next year, is up from the one rate hike it had projected in September.

The Federal Reserve is shifting its attention away from reducing unemployment which has fallen to 4.2% in November, down from 4.8% in September – toward curbing inflation.

2022 promises to be a challenging year, testing investors’ strategies as they leverage the opportunities and navigate the risks of slower growth, loosening stimulus programs, and rising real interest rates.

EquityRT’s economic coverage is continuously expanded by new indicators that help investors and analysts keep an eye on the big picture. Contact us at info@equityrt.com to get further information on the content details.

Report by Özge Gürses | Macro Research at EquityRT