Analyst Expectations

Earnings Estimates

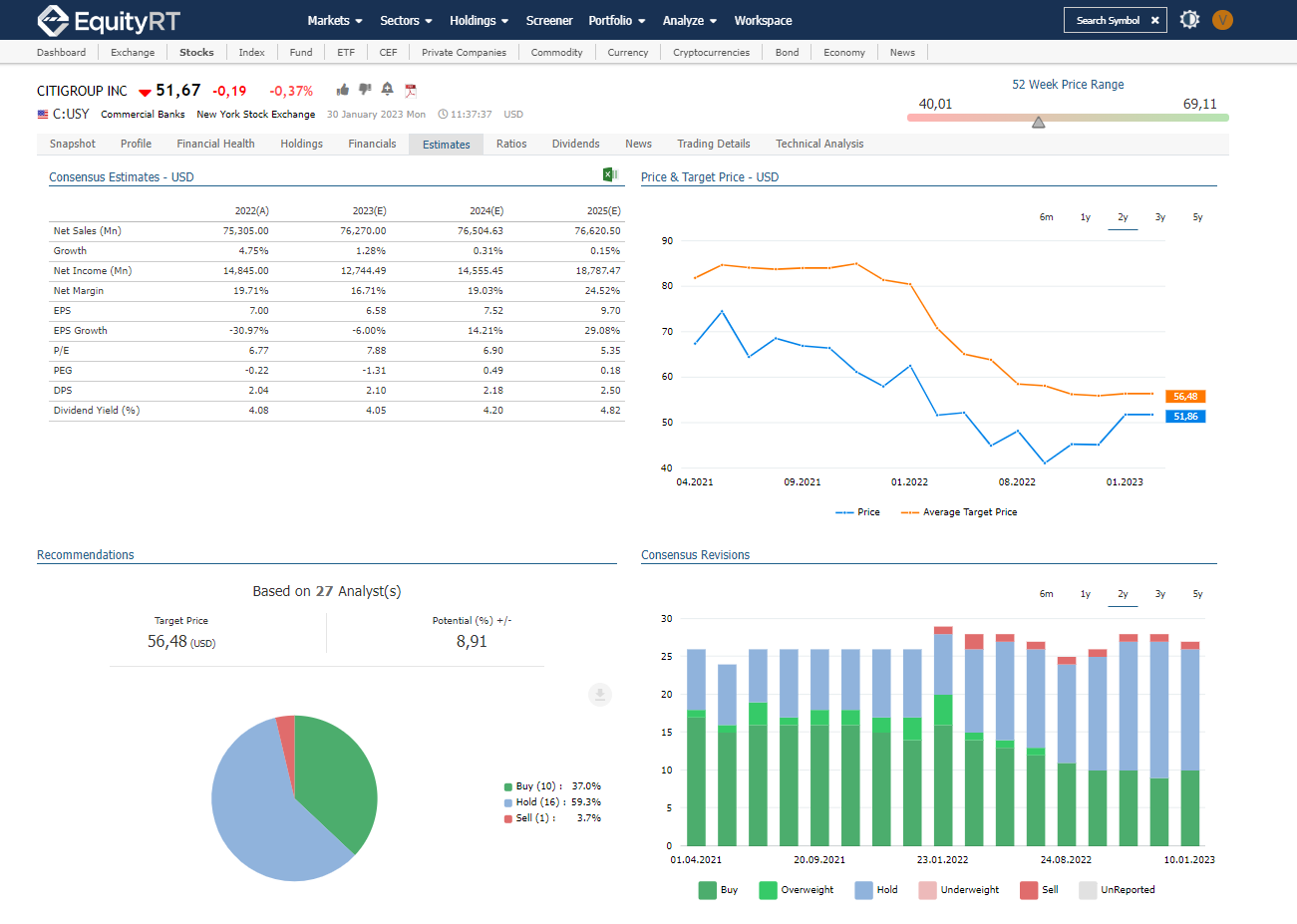

Stock prices are established based on the expectations that prospective investors have for the future earnings power of the company. The future earnings power of any company involves the interaction of many company, industry, and economic climate. Earnings estimates depends on the factors such as sales growth, product demand, competitive industry environment, profit margins and cost controls.

- By contributing share and foreign currency estimations for a quarter or year-end, you can use this information in your reports via functions.

- Target Market Capitalization, Net Sales, Net Profit, EBITDA, Forward EV/EBITDA and Forward P/E

- Recommendations (Buy, Sell, Hold)

Market Consensus

Market consensus is the average of analysts’ estimates for the upcoming quarterly results. When we say a company has “fallen short of estimates,” we are referring to market consensus. A company with earnings greater than the stock market consensus generally goes up because it “beat estimates.” On the other hand, a company that does not perform as well as analysts expected is said to “miss estimates,” and the company normally sees its stock decline in value.

The size of a company and how many analysts are covering it also influence the stock market consensus. If only a handful of analysts are assigned to the stock, the market consensus estimates are more likely to vary from actual results.

- Reviewing forecasts, you will be able to make yours more detailed and realistic.

- You can examine changes in the consensus of an estimated data item of any security in time.

- You can review historical trends and changes which have taken place in the expectations.