Equity Research

Fundamental Analysis

Fundamental analysis is accepted as the cornerstone of investing and is about spending time going through anything that can affect the stock value. Intangible aspects like quality of management and market share also have a great importance in analysis. A company’s fundamentals are basically divided into two main aspects; the quantitative fundamentals and the qualitative fundamentals.

Quantitative Fundamentals

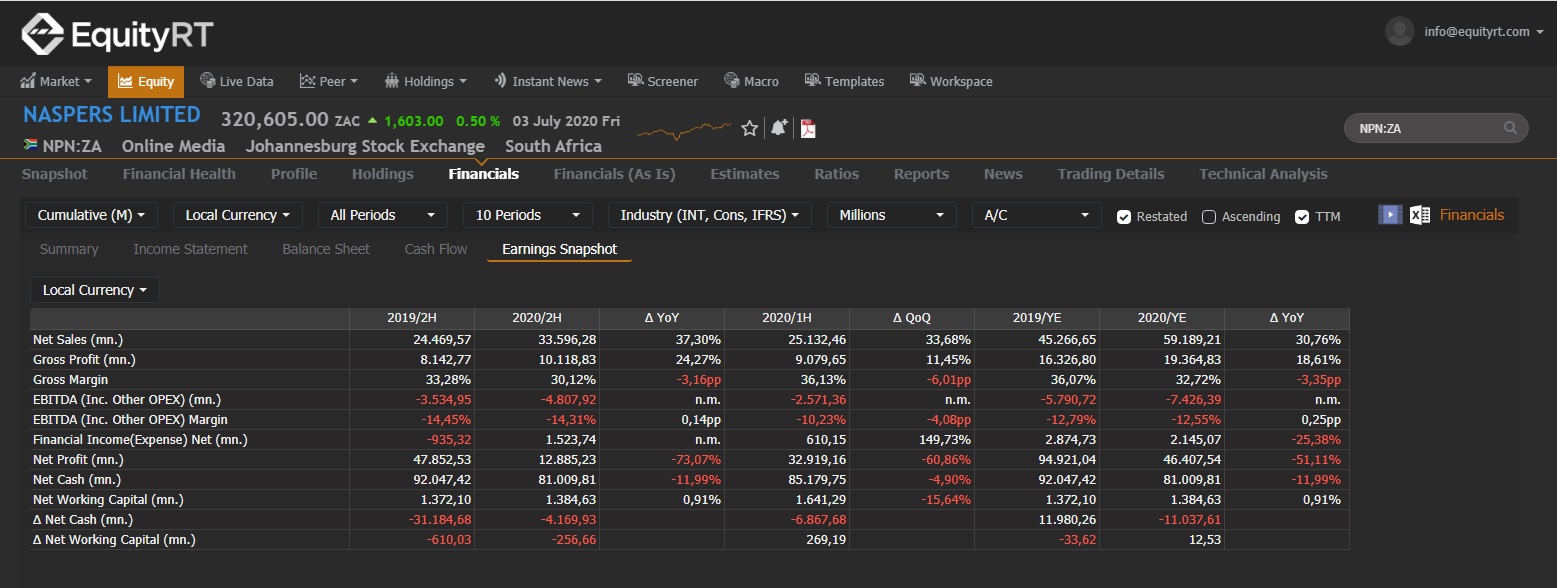

Quantitative Fundamentals are capable of being measured or expressed in numerical terms and can be obtained from the financial statements of the company. Income statement, cash flow statement and balance sheet are the three key fundamentals to consider.

- Income statement shows the amount of money had been produced and spent in a period of time as a result of the business’ operations and measures the company’s performance.

- Balance sheet represents the ability of the company to balance the resources that the business owns or controls.

- Cash flows focuses on the cash from investing, cash from financing and operating cash flow representing cash inflows and outflows in a period of time.

Qualitative Fundamentals

Competitive advantage, management, corporate governance and the business model are the key qualitative fundamentals to consider whilst analysing a company to invest. And it’s also important to consider how the company’s industry works. Learning about how the industry works gives a deeper understanding of a company’s financial health.

- Competitive advantage is the catalyst that drives the long-term success of a company.

- Management is one of the most important criteria to consider because a good team can make a big difference and if the leaders fail to execute a plan, it is not possible to be successful even with the best business model.

- Corporate Governance represents the policies denoting the relationships between stakeholders, management and directors and their responsibilities.

- Business model basically represents how the company generates value for its customers.