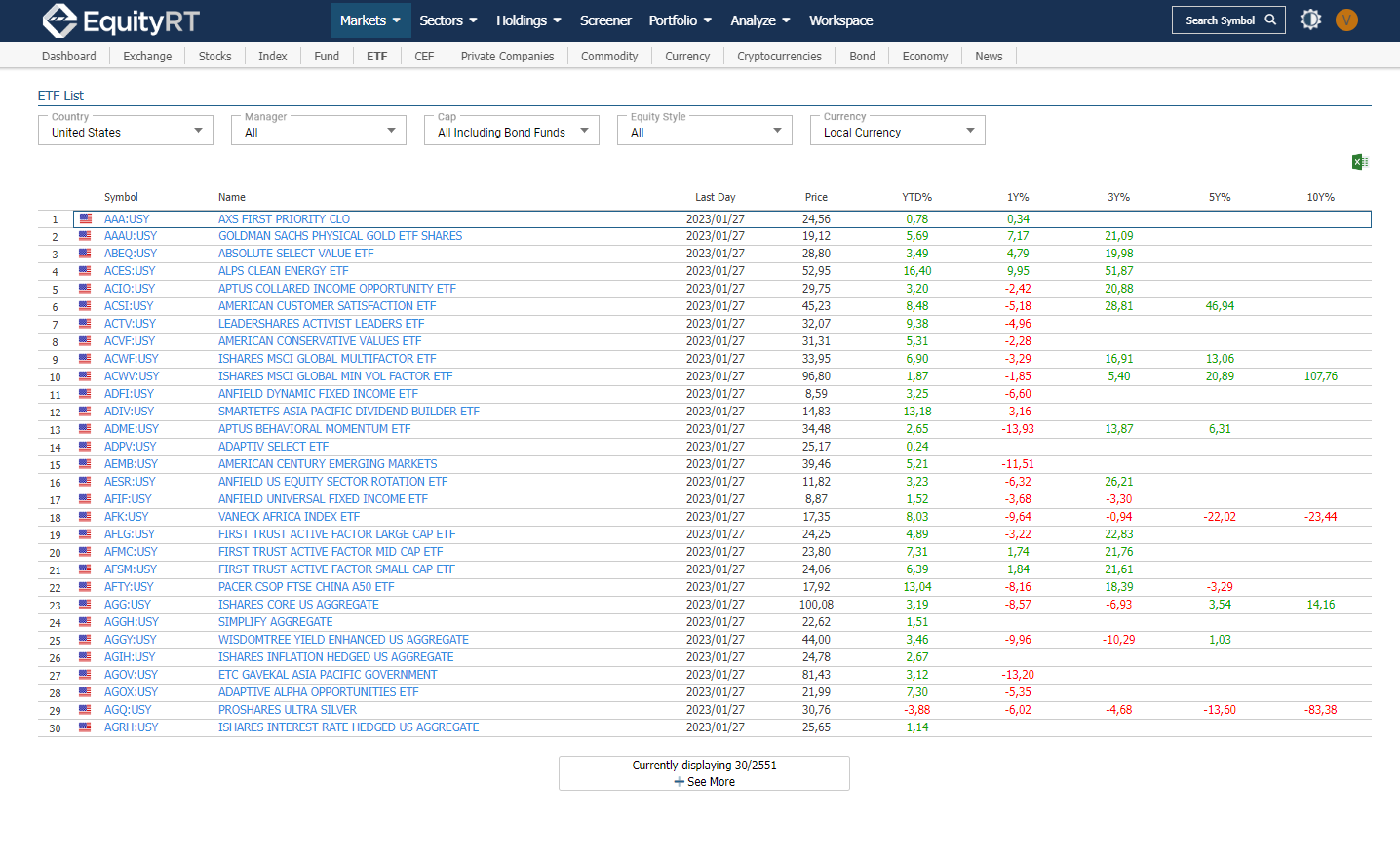

Exchange Traded Funds

What is an ETF?

An exchange-traded fund (ETF) is an investment fund traded on stock exchanges, just like stocks. An ETF holds assets such as stocks, commodities, or bonds as well as generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occasionally take place. Most ETFs track an index, such as a stock index or bond index.

Advantages of Exchange Traded Funds

The biggest advantage an ETF has over a mutual fund is taxation. Due to their construction, ETFs incur capital gains taxes only when you sell them. Mutual funds incur capital gains taxes as the shares within the fund are traded throughout the life of the investment. Favoring ETFs over mutual funds can lower your tax bill from your long-term investments.

ETFs are also more cost-effective than mutual funds. ETFs are often, though not always, passively managed, meaning they’re set up to track the return of a particular benchmark. There’s no asset selection process involved. Since mutual funds are often actively managed, they’re generally subject to higher management fees.

When an investor moves a managed portfolio to a different investment firm, complications can arise with mutual funds. With ETFs, the transfer is clean and simple. They are considered a portable investment, which offers a nice advantage over mutual funds.